With sales of condominiums picking up again, it’s unclear if buyers are hesitant about density

According to a Harris Poll survey conducted at the end of April this year, 39% of urban dwellers said the COVID-19 crisis has prompted them to consider leaving for a less crowded place. In addition, a number of recent news articles[1] bring into question desirability of high-density living.

In the following analysis, we examine recent changes in demand for condominiums as well as any potential impact on prices and inventory. Condominium information is derived from a CoreLogic database containing transactions from more than 150 multiple-listing services (MLSs) across the country.

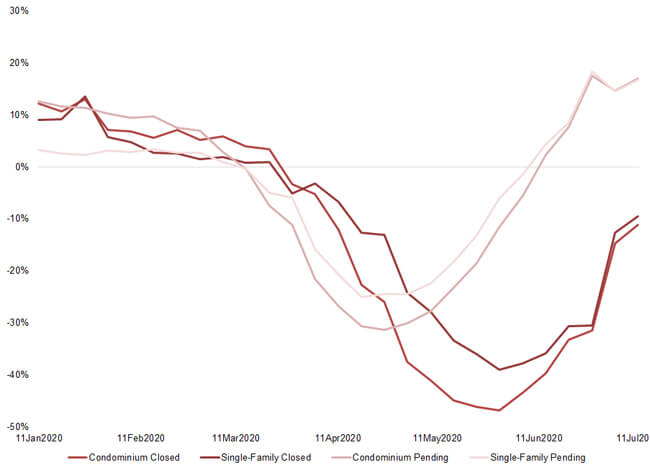

Condominium settlements take a larger dip but rebound healthily

Though condominium and single-family detached home sales have tracked relatively close over the last few years, sales of condominium units started to accelerate at a faster rate than single-family detached homes in late 2019. In the first 10 weeks of 2020, condominium sales averaged about 8% above last year’s sales while single-family detached sales averaged about 5.5% higher compared to last year. Figure 1 depicts condominium and single-family detached trends beginning in the fourth quarter of 2019 for closed sales and pending contracts.

As we reported in some earlier analyses, sales of homes declined precipitously following the onset of the pandemic with pending contract signings falling immediately following the declaration of the national emergency, and closed sales following 30 to 45 days later, reaching the trough by the end of May.

Nevertheless, the plunge in sales was relatively greater among condominiums, hitting a low year-over-year point at 47% at the end of May. In comparison, while single-family sales declined notably as well, the drop bottomed out at 39% also at the end of May.

After hitting their nadir, both condos and detached home sales picked up pace. And while we’re still seeing lower closed sales in comparison to last year, the slippage is far less.

As pending trends in Figure 1 suggest, home sales activity rebounded for both property types, and started exceeding the rate of pending sales in mid-June compared to last year. The increase is likely to be reflected in closed sales over the next couple of months. Interestingly though, while condominium sales took a larger dip during the peak of shelter-in-place orders, pending contracts have healthily rebounded to the same rate of annual growth as seen for single-family homes, with both averaging about 17% year-over-year increases in the first two weeks of July.

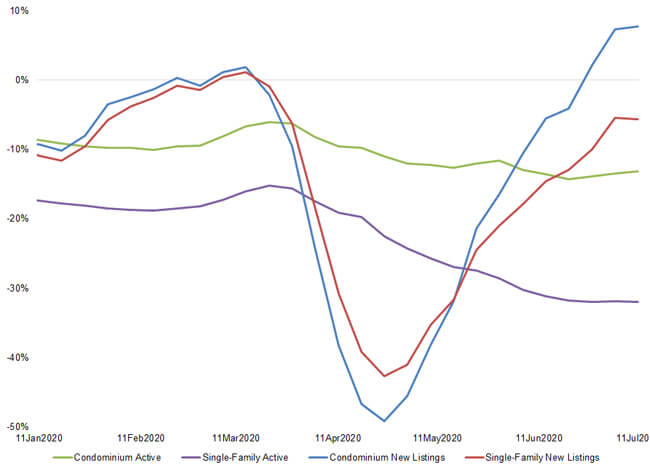

New inventory of condominiums outpaces single-family growth in June

Condominium sales have shown signs of a rebound, however, other housing market indicators suggest there is divergence in trends between the two types of properties. Figure 2 illustrates year-over-year change in active and new inventory for condominiums and single-family detached homes. Active inventories for both types of homes have been on a continuous decline since the last quarter of 2019, but while availability of single-family homes continues to fall at a hasty pace – down about 30% in the mid July – waning of condominium active inventories has leveled off at about a 13% year-over-year decline since May.

The stabilization in condominium inventory reflects an increase in newly available inventory. After dipping to a 50% year-over-year fall during the height of the shutdown, we have seen a rapid growth in new inventory and recorded an 8% increase by mid-July. In looking by price tiers, the largest increase in new inventory in June was among condominiums priced at 200% or more of the median price – up 16% from last June. Moreover, newly listed inventory of condominiums priced below 100% of the median price was up 5%, and new inventory priced between 100% and 200% of the median price was up 2% year-over-year in June.

Faster rebound of for-sale condominium inventory may reflect the difference in tenancy as condos are more likely to be non-owner occupied, i.e. rental or vacation, and thus potentially vacant which make it easier for an agent to show the listing.

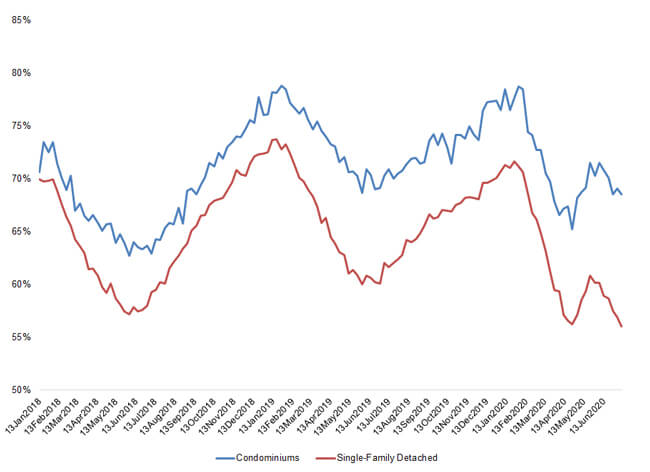

Difference in the share of selling below the asking price increases since the pandemic

Another divergence is seen in the share of homes that sold below the asking price. Generally, as Figure 3 illustrates, the share of condominiums that sell below the asking price is higher than the rate for single-family detached homes.

Over the last two years, the difference between the two types of properties averaged about 6%, with some seasonal variations. But since the onset of the pandemic, both types of properties saw a disruption in the seasonal pattern. These properties generally see low points from April to June, but as the discount share for single-family homes started falling again at the end of May, discount share of condominiums remained elevated, averaging 11 percentage points higher in comparison to detached homes.

The difference in the share of discounted sales may not necessarily reflect lower demand though, since active inventory of detached homes has taken a bigger hit due to the pandemic and has been slower to rebound. Thus, lower supply of detached homes is likely to drive transactions at or above the asking price.

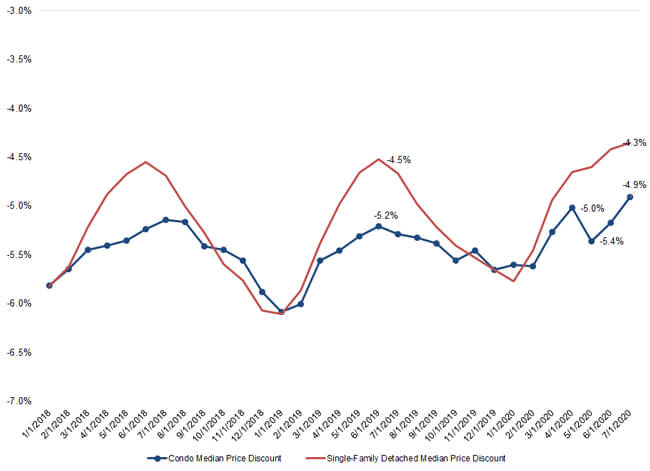

Median discount for condominiums picks up in May, but falls back in June

Lastly, in looking at the median discount of homes that sold below the asking price, Figure 4 denotes that while condominiums did see an uptick in discounts – from 5.0% in April to 5.4% in May – the median discount reverted to 4.9% in July. On the other hand, detached homes during the same time did not see an uptick in discount rate but continued to trend lower despite the onset of the pandemic. Still, condominium discount is at the lowest rate it has been in at least the last 2.5 years.

To conclude, while the pandemic has impacted our views on desirability of density environment, it is clear that home buyers have not given up on condominiums.

© 2020 Corelogic, Inc. All rights reserved.

For more Insights from CoreLogic, check out our blog– delivering expanded perspective on the housing economy and property markets.

And for more on how the property industry has been affected by the COVID-19 pandemic, visit our dedicated COVID Housing Analysis page.

[1] https://www.mansionglobal.com/articles/amid-the-covid-19-crisis-single-family-homes-may-be-the-smart-investment-215236